Section 2: Budgeting for Student Life

One of the things to think about when you arrive at Buckingham is money.

Why is budgeting important?

- A budget can help you feel more in control and give you the power to make decisions to make the most of your money.

- Knowing where your money goes, is key to making sure you can enjoy your time at Uni.

- Getting on top of this early in the term, will allow you to focus on your studies.

Fun Fact: Did you know, the average person in the UK spends 77p in every £1 they earn. They work until mid March to pay their tax and NI and from then, until Christmas, to pay off day to day expenses i.e. food, electricity bills, gym, phone memberships etc. The remaining few days of the year is the disposable money the average person has left to save.

Task 1: Watch the Video - Creating the budget

Task 2: Thinking about your budget: Income

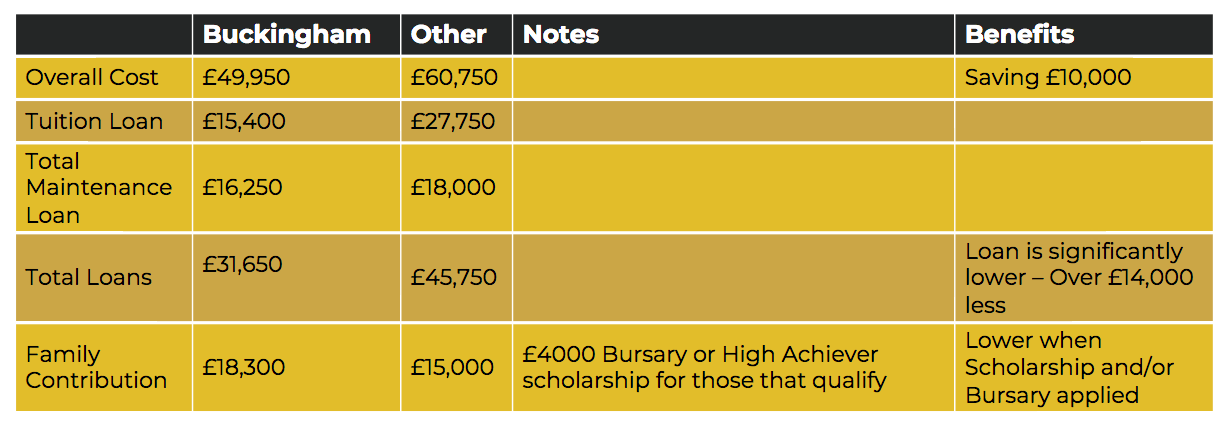

Review the Buckingham specific information and use this to help you create a draft budget for your first year.

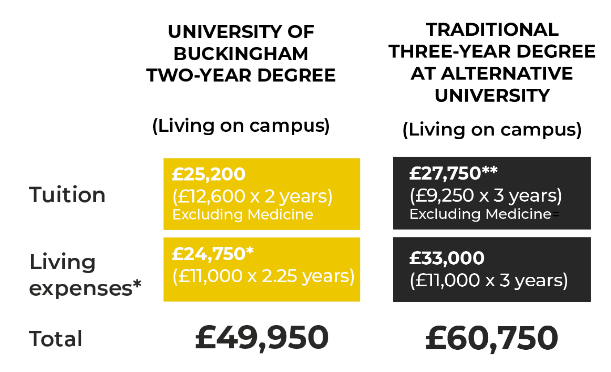

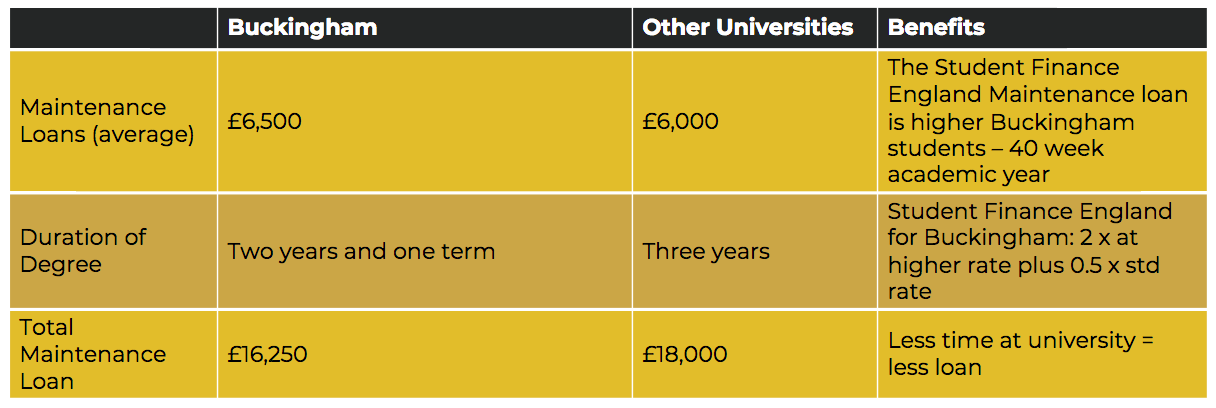

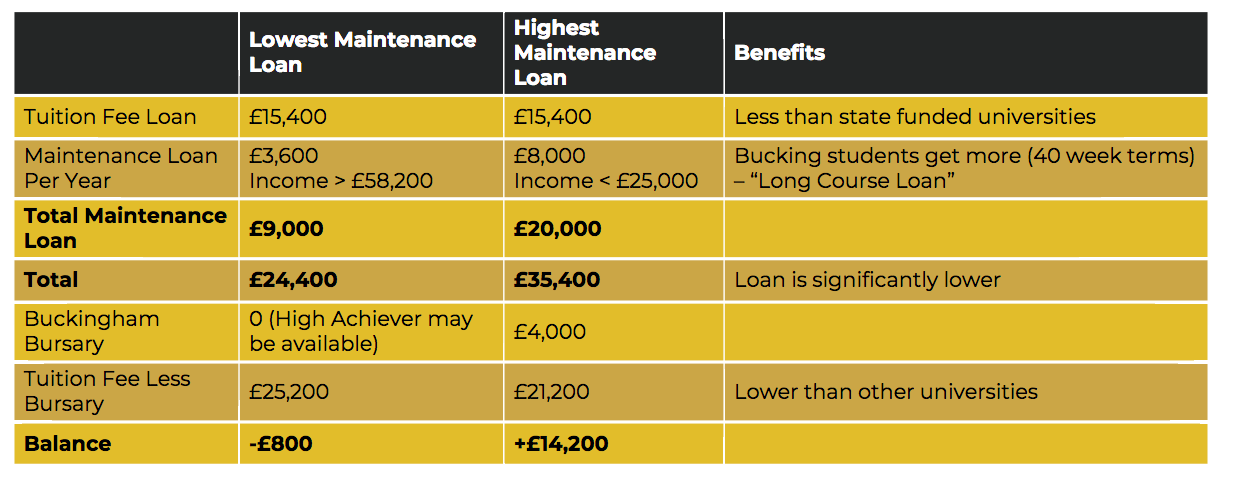

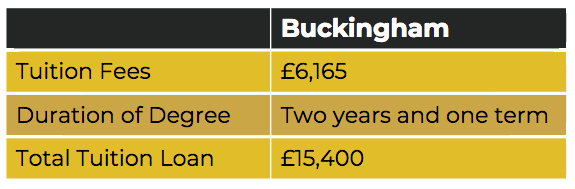

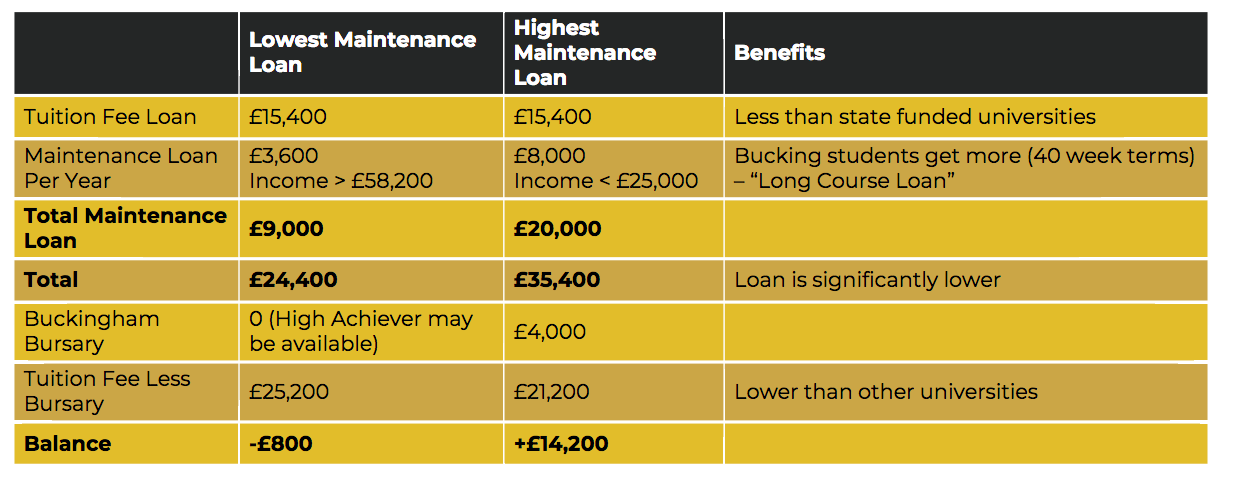

Remember that Buckingham's fee system is slightly different to other Universities:

Understanding your income

Enter all income likely to be available to you whilst at Buckingham e.g. *maintenance loan, regular top ups to your loan from family, income from part time work or savings into your budget

What your money could look like if living at home

Make loans lower by making a slightly higher contribution

Buckingham students can apply for a Maintenance Loan of up to £8,200 per annum, in the same way as students at other UK universities. Make sure you have applied for all the student finance you are entitled to. Also look into scholarships and bursaries

Do the research and check whether you will be eligible. Eligibility criteria are likely to vary depending on your chosen degree.

*NOTE: this is the only time a loan would be considered as income

Task 3: Read the Text - Thinking about your budget: Priorities

Factoring in bills

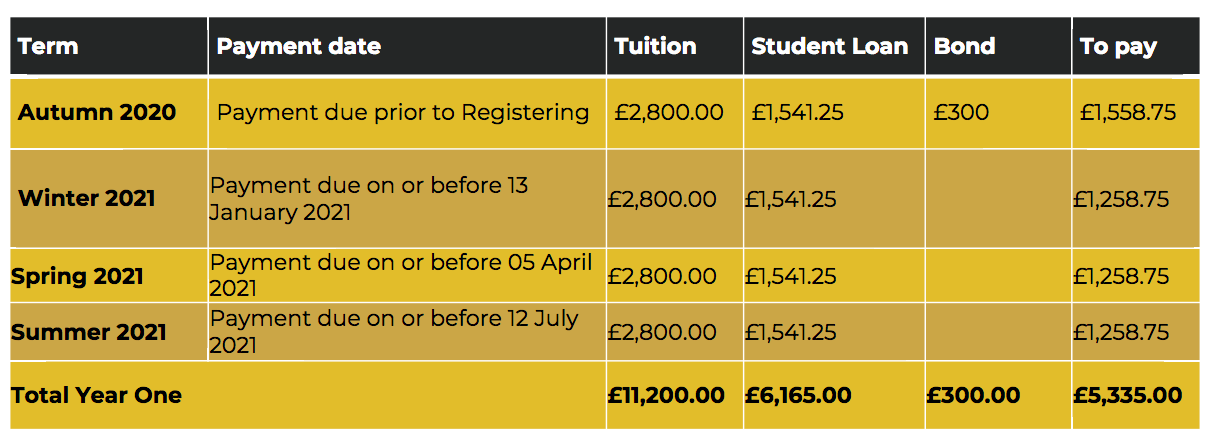

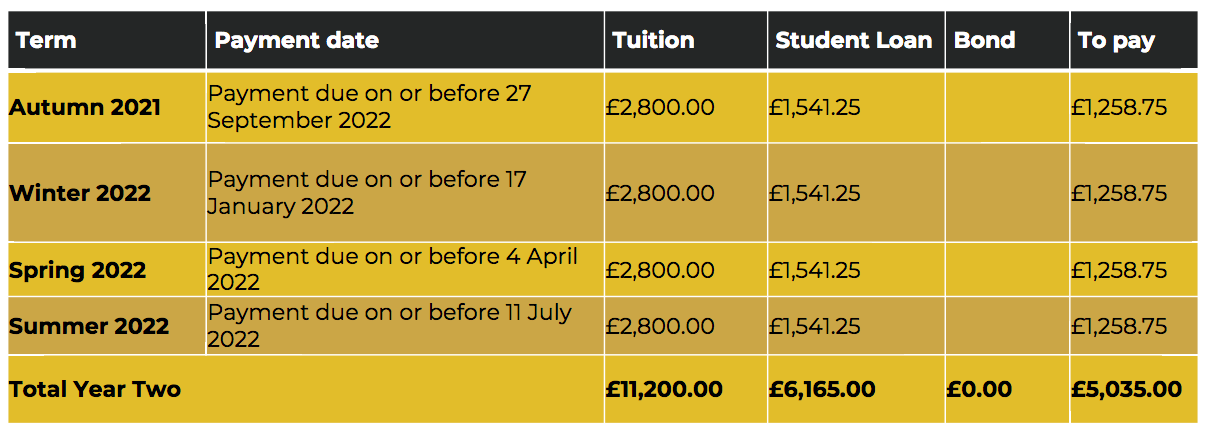

When thinking about living away from home, it’s important to prioritise payment of certain bills. Some bills have serious consequences if left unpaid or paid late. Tuition fees (for those of you self-funding your degree), rent and bills should be at the top of your list when budgeting. It’s also important for various reasons that these are paid on time. In some cases, there will be additional upfront payments needed when renting accommodation.

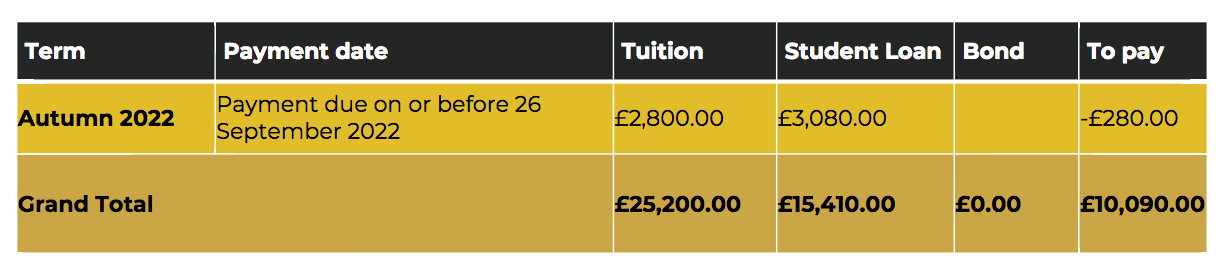

The tables below provide a guide of the amounts to budget for, along with key timelines if self-funding your degree

Tuition Fee Loans

Undergraduate (September) Tuition Fees - Year 1

Undergraduate (September) Tuition Fees - Year 2

What might your costs look like?

Use the ‘budget template: expenditure’ sheet to create a budget of other likely living costs. Visit our website for an idea of what students at Buckingham actually spend.

Task 4: Read Text - Thinking about your budget: Additional costs

It's important to factor in the following costs:

Course materials

You'll need to buy your own stationery and maybe some textbooks at University. Whilst these costs can seem small, they soon add up over time. Your School will give you a list of recommended reading for your degree programme. This will be the starting point for calculating how much you need to spend.

Try to keep these expenses to a minimum by:

- Using e-books and the library for books where possible - be sure to avoid late fees!

- Buying second hand books - look out for textbooks being sold by former students or visit local charity shops in Buckingham.

- Print in black and white and on both sides to reduce printing costs.

Transport

Whether it’s your commute to class, heading back home for the holidays or frequent trips to other parts of the country to visits friends, family or sightseeing, you’ll need to include some travel costs in your budget.

If you choose to live on campus whilst studying at Buckingham, all University accommodation is within walking distance to University lecture halls so you’ll be saving some money here. A minibus is also provided free of charge throughout the day, running between all our main campus sites.

There are various student travel cards and deals to reduce costs, so check what transport companies offer and book in advance for additional savings. Examples include: 16-25 Railcard (saves one-third on train fares), Young Persons Coachcard (saves one-third off coach travel), Student Oyster Photocard (saves 30% off London travel cost)

- Shop smart with student discounts

- Food prices vary between shops, so shop around. Items are cheaper if you buy value labels or the supermarket’s own label.

- A few tips to help you stay on budget:

- Make a shopping list before setting off and stick to it!

- Learn one or two easy dishes to cook in bulk and store in the freezer.

- Compare prices of basic products at different supermarkets before you buy.

- Don't forget to budget for soap, shampoo, and other toiletries.

- There are lots of great discounts available to students in shops, charity shops, restaurants, transport, etc.

- But don’t use this as a reason to spend money on things that you don’t really need!

Entertainment and socialising

Fresher’s week, student nights, sports club socials, gigs, fancy dress, coffees, lunches… the cost of socialising can quickly add up. To get an idea of events and likely costs check out the SU events calendar

Consider also taking part in:

- Free events at your union

- Two-for-one cinema nights

- Game nights in with housemates

Don’t forget to include additional lifestyle costs into your budget.

Remember: your lifestyle costs are likely to be different at different times in the year. You’ll spend more during Freshers' week than an average week or if you go home for holidays. Also, for most of us Christmas is one of the most expensive times of the year!

Fun Fact: First-year students report that the majority of their spending goes towards Rent, food and social activities.

Task 5: Watch the Video: How to maintain your budget

Task 6: Look Through our Recommended Resources and Apps

Here are some resources we recommend related to budgeting:

Website, Articles and Downloadable tools:

Apps to keep track of budgeting and spending:

- Yolt – Allows you to track your finances and manage your overall spending. You can use categories to see how much you're spending in different areas.

- Cleo – Works through Facebook and takes a read-only (so no one can ever move money in or out of your account) look at your spending to help you keep track of your finances.

- Money Dashboard – Categorises your spending and displays all incoming and outgoing amounts on a dashboard chart, so you can see what you spend in different areas.

- Pariti – Connects your bank accounts: you can view what you have coming in plus set spending goals. It updates automatically each day so you can see what you've left to spend.

- Spending Tracker – You can choose to track your spending weekly, monthly or yearly.

Congratulations!

You have now completed Section 2: Student Life